How do we get everyone to home sweet home?

Tackling Connecticut’s housing crisis with creativity and community

If you live in Connecticut, you or someone you love has probably struggled to find and afford housing. Finding a place to rent in your town, affording a down payment on a house, navigating landlords and interest rates – most people in our state have encountered one or all of these hurdles as we try to find a place to call home sweet home.

For people trying to become homeowners, Connecticut is experiencing a severe housing affordability crisis. In the last year alone, home prices have increased by 9.64% in our state compared to 6.6% nationally. This June, five Connecticut metro areas were among the top 20 highest demand markets. Hartford had the hottest market in the country, followed by New Haven-Milford (No. 9); Worcester-Northeast CT (No. 12); Bridgeport-Stamford (No. 13); and Norwich-New London (No. 19). With a lot of people looking to purchase homes and the lack of inventory of homes on the market, prices have gone up throughout the state, with median list prices ranging from $430,000 in New Haven County to a staggering $960,000 in Fairfield County.

It's not just home sales prices that have shot up. Tenants have also experienced significant rent increases over the last few years. For instance, for years, New London County had fairly stable rent prices and low rent price hikes. But in just a little over three years, the average price of a one-bedroom rental skyrocketed by 37 percent. According to Zillow, the Hartford Metro area has the fastest-increasing rent prices among the country’s major housing markets, with rents up 7.8 percent this July compared to last July.

Statewide, the average rent for a two-bedroom apartment is nearly $1,800 per month. Experts say that for housing to be considered “affordable,” it should take up no more than 30 percent of a household’s budget. To make the Connecticut average of $1,800 per month “affordable,” a household would need to earn at least $72,014 annually or have an hourly wage of $34.62 per hour.

At the end of the day, low-income Connecticut residents need around 92,560 more affordable housing units to make sure everyone has a place to call home sweet home.

So how did we get here?

So how did we as a state get here? The reality is the affordable housing crisis has been decades in the making.

Low construction: Like other states, Connecticut has historically increased and decreased new housing construction connected to cycles of the economy, with more construction happening when the economy was strong and less happening when it was not. Housing construction never recovered after two big economic downturns: the “Savings and Loan” crisis in the late 1980s and the “Great Recession” in 2008. The decreased production means Connecticut has some of the oldest housing in the country, with a median year built of 1966 compared to 1980 nationally.

High demand: Connecticut is a good place to live, and more people recognize that. Connecticut historically has had modest population growth. But recent census data has shown that Connecticut’s population has grown by just under half a percent – a big increase for our state. More importantly, more people are creating households, and therefore looking for their own places to live. The increased household formation is largely because of millennials, the largest generation in the country as of 2020. With millennials entering their late twenties, thirties, and even forties, more are forming their own independent households. Housing stock hasn’t kept up with the size of this generation or with people moving here from other states, so there is more stress on an already competitive housing market.

Racial Discrimination in Housing: Redlining is a discriminatory practice that emerged in the throughout the country during the 1930s. This practice was a form of systemic racism in which Black neighborhoods were marked as high-risk for mortgage lending by banks and other financial institutions. The history of redlining in Connecticut, particularly in cities like Hartford, New Haven, and Bridgeport, has done lasting harm to the state's racial and economic landscape, especially for Black residents.

Racial covenants in housing were legal agreements embedded in property deeds that prohibited the sale, lease, or occupation of property by certain racial or ethnic groups, particularly Black people, in many parts of Connecticut during the early to mid-20th century. These covenants were a tool used to enforce racial segregation in residential areas, ensuring that neighborhoods remained exclusively white. Despite the Fair Housing Act of 1968, which made such discriminatory practices illegal, the legacy of racial covenants has had a lasting impact on the racial and economic landscape of Connecticut.

These covenants contributed to the systemic exclusion of people of color from wealth-building opportunities through homeownership, leading to patterns of segregation and inequality that persist today.

While legal protections against discrimination like redlining and racial covenants have improved, the effects of these past practices continue to hurt many people today. Addressing these challenges requires ongoing commitment to equitable housing policies and investment in communities that were historically marginalized.

NIMBY: Connecticut’s strict town laws and high construction costs have made it harder to build new housing. For example, many Connecticut towns have laws that favor large parcel, single-family housing development over multifamily homes. Town laws that limit density result in higher construction costs and restrict the overall supply of new housing that can be built. Towns and cities also often impose fees and have lengthy approval processes for new affordable housing projects. At times, this may include multiple rounds of public hearings, extending the timeline for construction, increasing costs, and discouraging investment in new affordable housing projects. Unfortunately, Not in My Backyard (“NIMBY”) attitudes keep these laws and policies in place. NIMBYism means opposing new construction in someone’s own town, often without opposing construction in other places – and it’s often based in prejudices about low-income people and Black, Latine, and other people of color.

NIMBY opposition frequently delays or even blocks projects from moving forward. This perpetuates economic and racial segregation by limiting housing options for lower-income families.

Harnessing Community Power for Positive Change

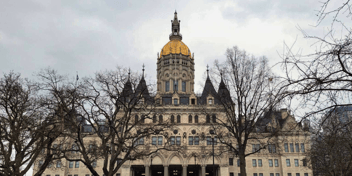

The affordable housing crisis is complex but solvable. New and better housing solutions led by stakeholders and residents will result in a more just and equitable affordable housing system. At The Connecticut Project, we are committed to advocating for effective housing solutions at the state capitol and working closely with local nonprofits to ensure every person has a quality home they can afford.

By coming together as a community, we can turn the tide on this pressing issue and advocate for solutions that empower Connecticut families.

Join us in this effort to create a brighter future for all residents, ensuring that every family has access to safe, affordable housing. Take action today!

.png?width=352&name=TCPAFPinkYellowBanner%20(1).png)